Though frameworks can help us structure our thinking, it is important that we select one that is appropriate for our specific requirement. Economic Value Added (EVA) is a framework intended to align the financial performance of organisations with expectations of investors. Conceptually the framework is easy to understand. The price investors are willing to pay for the company’s share matches the return they expect on their investment in the form of dividends and share price appreciation. If at a certain point in time potential investors get wind of a possibility that the company will be more profitable than previously expected, the price of the share will go up correspondingly.

On this basis, the market capitalisation of the firm (the aggregated market value of its shares) represents the future income stream that firm will provide to investors in terms of dividends and share price appreciation. There are of course, some adjustments to be made for the assets owned by the company, and to that way in which profit is calculated, but the EVA framework provides a mechanism for establishing financial targets for the company. If the company meets these targets, the price of the share will stay at its current level. If the future plans of the company indicate performance better than targeted, investors will be willing to pay more for the share and therefore its price will go up.

The framework can be very useful in establishing financial performance targets. EVA provides a way to establish exactly how much profit a company needs to make in future years to justify its share price. This profit expectation can be broken down into the profitability of the parts of the organisation, such as the strategic business units of a conglomerate and further down. This is a much more granular measure of performance than just the share price, particularly for executives at lower levels in the organisation.

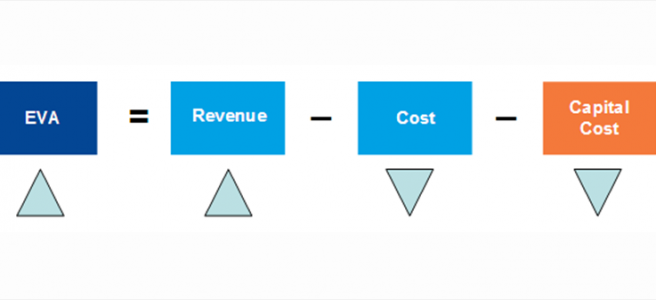

Within the EVA framework, profitability has three drivers: revenue, margin and cost of capital. Revenue and margin are self-explanatory. The more product or service the company sells, the higher the profitability. And the bigger the difference between the cost of providing the product or service and the price the customer pays, the higher the profitability. So it’s quite obvious that the company needs to try to increase both its revenue and its margins.

Cost of capital on the other hand, is not as intuitive. It is the cost of holding the asset and must be subtracted from profitability as calculated using conventional accounting methods. If the company doesn’t earn enough returns on the assets it owns, the investors might just as well invest in the assets directly instead of buying the company’s shares. For example, having a lot of cash on hand might seem like a good thing. But from an EVA perspective it is not, because cash doesn’t earn very much by way of interest. If the company has a lot of cash and can’t think of a better way to use it than putting in the bank, it would be better to return it to investors by buying back shares. This would increase the value of existing shares not only because the valuation of the company would be distributed over fewer shares, but also because the cash would no longer be a drag on profitability.

Now that we’ve looked at how EVA works, the next step is to figure out how to apply it to improve performance. Once financial targets are established, EVA does provide some ways to do this. But it may be useful at this point to compare EVA with the Balanced Scorecard (BSc) in this respect.

The BSc is based on a certain approach to strategy, as captured by the strategy map. The strategy map describes how intangible assets can be leveraged, through process performance and customer outcomes, to improve performance. If the organisation is comfortable with this approach, the strategy map can form the basis for a compelling articulation of strategy.

The approach adopted by many proponents of EVA is to construct a tree that shows the components of the three drivers. Once the drivers are broken out into their components, each component is evaluated for the ease with which it can be influenced and a set of actions is identified for implementation. When implementing the framework for a consumer products company the consultants split out the total revenue into the products in the product range. Their analysis showed that the smallest pack-size for one of the products, was generating revenue, but losing money. The consultants recommended either increasing the margin on this product to make it profitable or discontinuing it entirely. In this particular case the product happened to a small pack-size intended to encourage customers to sample the product before moving on to the larger standard pack, i.e. it was a loss-leader designed to support revenue generation for the standard pack. This is a good example of how a financially focused approach can sometimes seem to be missing the mark.

But there is another, perhaps more fundamental, concern with EVA. Its primary focus is the investor. If the organisation has adopted a more balanced stakeholder approach, EVA may not be the best fit. Interestingly, the BSc is also strongly investor focused. In the standard strategy map the causal chains all end at measures of financial performance. The strategy map therefore appears to suggest that customers and employees are the means to meeting the needs of investors, rather than important stakeholders in their own right. That’s another reason why it is important to select a framework that matches the needs of the organisation.

In this post we have looked at the EVA and BSc frameworks. Last week we compared the BSc with the Business Performance Management (BPM) framework. But do the BPM and EVA frameworks serve the same purpose? We’ll take a closer look next week.

If you are interested in learning more about organisational alignment, how misalignment can arise and what you can do about it join the community. Along the way, I’ll share some tools and frameworks that might help you improve alignment in your organisation.